Insight: The Fundamental Flaws of ESG Investing

While environmental, social, and governance (ESG) factors can have a direct bearing on an organization’s performance, as indicated by the performance of many sustainable funds, investing in sustainable funds is and will remain a highly subjective process.

While environmental, social, and governance (ESG) factors can have a direct bearing on an organization’s performance, as indicated by the performance of many sustainable funds, investing in sustainable funds is and will remain a highly subjective process. ESG and Stakeholder Capitalism Are Not a Panacea

ESG Is In the Eyes of the Beholder

It is one thing to state that organizations with highly engaged customers, employees, distribution partners, and communities and that are dedicated to sustainability have a better chance of ongoing success than those companies with disengaged stakeholders and contentious communities. It is another to say that investing in a basket of so-called ESG companies is the best place to put one’s money.

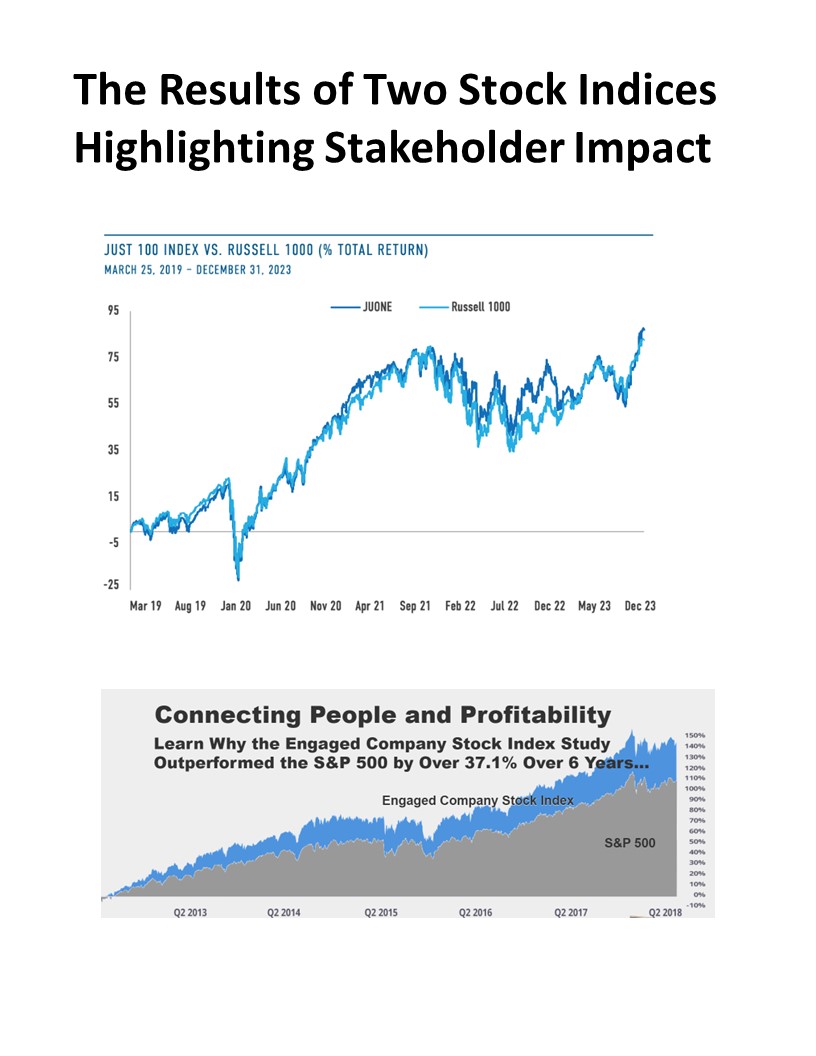

The Enterprise Engagement Alliance was among the early research organizations to create a professionally managed mock Engaged Company Stock Index to specifically track the impact of having highly engaged customers, employees, and communities over time on stock prices. Largely excluding environmental considerations, the six-year research project was based on the Good Company Index developed by the Colorado-based analytics firm McBassi & Co. Using 13 separate metrics, it outperformed the S&P 500 by 37.1% over six years.

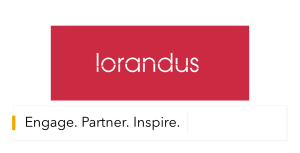

While the general emphasis of ESG funds have a significant focus on the environment, more funds have sprouted that address the social and governance issues originally covered by the EEA. Goldman Sachs launched the JUST Company ETF based on the framework of JUST Capital, a not-for-profit outreach group that rates companies on how they serve the priorities of the American public, and Barron’s 100 Most Sustainable Companies, managed by Calvert, that also includes many stakeholder factors. Both have outperformed the indices against which they benchmark themselves, although Calvert has not yet released 2023 results.

ESG and Stakeholder Capitalism Are Not a Panacea

No one can safely argue that a focus on stakeholder capitalism principles or ESG is a guarantee of success. On the other hand, there is a lot to learn about why various funds perform as they do. For instance, JUST Capital reports that:

“*The broad-based index (on which the JUST ETF is based) has outperformed the Russell 1000 by just over 10.34% since Dec. 1, 2016.

*The JUST 100 Index has beaten the Russell 1000 Equal Weighted Index by 38.5% since its inception and 3.1% YTD.

*The worker-focused index has outperformed the Russell 1000 Equal Weighted Index by 103.75% since Jan. 1, 2018.

*The spread between top decile and bottom decile of companies as ranked by JUST Overall score from January 2018 is an astounding 75.45%.”

It should come as no surprise that companies that align the interests of their shareholders and stakeholders have a better chance of achieving sustainable performance than those that don’t. That doesn’t mean that the creators of ESG funds share the investor’s definition for sustainability. And what's most important to understand is the practices that result in achieving this path to sustainable performance.

ESG Is In the Eyes of the Beholder

The report on the impressive results of the Morningstar’s top five sustainable funds in 2023 indicate sustainable investing can be in the eye of the beholder, because much of the gains apparently came from investments in AI and other technologies with potentially downstream environmental and social impacts, at least in the eyes of some. The chips that power AI consume enormous amounts of energy and water, in some cases in areas of potential global conflict, in others lacking in the necessary water requirements.

According to Morningstar, “Large-cap sustainable funds returned 24.1% in 2023. That paced the benchmarks, but the year’s best-performing funds in this category boasted returns that nearly doubled the market’s. In 2023, the Morningstar US Large Cap Index returned 26.7%, and the S&P 500 returned 23.8%. Sustainable investing encompasses a range of investment approaches that address the impact of climate change and other environmental, social, and corporate governance issues on their investments while seeking competitive results. Responsible investing, ESG investing, and impact investing are terms also used more or less interchangeably to describe the same set of approaches.”

Morningstar’s top five sustainable funds of 2023 were Invesco ESG Nasdaq 100 ETF QQMG, Clearbridge Large Cap Growth ETF LRGE, Parnassus Growth Equity PFPGX, Nuveen Winslow Large Cap Growth Equity ESG NWLG, and Blackrock Sustainable US Growth BSGKX.

Depending on the individual moral point of view, some might take objection to more than one companies in these portfolios. It is for each individual to decide to what extent they wish their moral considerations to factor into their investments, understanding that even organizations that appear to check off all the clear checkboxes for ESG and stakeholder capitalism can fail—FTX and WeWork immediately coming to mind.

ESM Is Published by The EEA: Your Source for Effective Stakeholder Management, Engagement, and Reporting

Through education, media, business development, advisory services, and outreach, the Enterprise Engagement Alliance supports professionals, educators, organizations, asset managers, investors, and engagement solution providers seeking a competitive advantage by profiting from a strategic and systematic approach to stakeholder engagement across the enterprise. Click here for details on all EEA and ESM media services.

1. Professional Education on Stakeholder Management and Total Rewards

- Become part of the EEA as an individual, corporation, or solution provider to gain access to valuable learning, thought leadership, and marketing resources to master stakeholder management and reporting.

- The only education and certification program focusing on Stakeholder Engagement and Human Capital metrics and reporting, featuring nine members-only training videos that provide preparation for certification in Enterprise Engagement.

- EEA books: Paid EEA participants receive Enterprise Engagement for CEOs: The Little Blue Book for People-Centric Capitalists, a quick implementation guide for CEOs; Enterprise Engagement: The Roadmap 5th Edition implementation guide; a comprehensive textbook for practitioners, academics, and students, plus four books on theory and implementation from leaders in Stakeholder Management, Finance, Human Capital Management, and Culture.

2. Media

- ESM at EnterpriseEngagement.org, EEXAdvisors.com marketplace, ESM e–newsletters, and library.

- RRN at RewardsRecognitionNetwork.com; BrandMediaCoalition.com marketplace, RRN e-newsletters, and library.

- EEA YouTube Channel with over three dozen how-to and insight videos and growing with nearly 100 expert guests.

3. Fully Integrated Business Development for Engagement and Total Rewards

Strategic Business Development for Stakeholder Management and Total Rewards solution providers, including Integrated blog, social media, and e-newsletter campaigns managed by content marketing experts.

4. Advisory Services for Organizations

Stakeholder Management Business Plans; Human Capital Management, Metrics, and Corporate Sustainability Reporting for organizations, including ISO human capital certifications, and services for solution providers.

5. Outreach in the US and Around the World on Stakeholder Management and Total Rewards

The EEA promotes a strategic approach to people management and total rewards through its e-newsletters, web sites, and social media reaching 20,000 professionals a month and through other activities, such as:

- Association of National Advertisers Brand Engagement 360 Knowledge Center to educate brands and agencies.