UAW Settlement Highlights Obsolete Model for Establishing Pay

The current process of establishing compensation based on what can be negotiated at the bargaining table reflects a fundamental flaw—the failure to consider objective measures of the value created by various categories of stakeholders in an organization. Only by understanding the source of value creation can organizations better understand where to invest their resources.

The current process of establishing compensation based on what can be negotiated at the bargaining table reflects a fundamental flaw—the failure to consider objective measures of the value created by various categories of stakeholders in an organization. Only by understanding the source of value creation can organizations better understand where to invest their resources.By Bruce Bolger and Darwin Hanson

Do Most Organizations Really Know Where the Most Value Is Created?

Understanding Where Value Gets Created

Targeting Investments Toward the Greatest Sources of Value Creation

Click here for links to information about EEA preferred engagement solution providers.

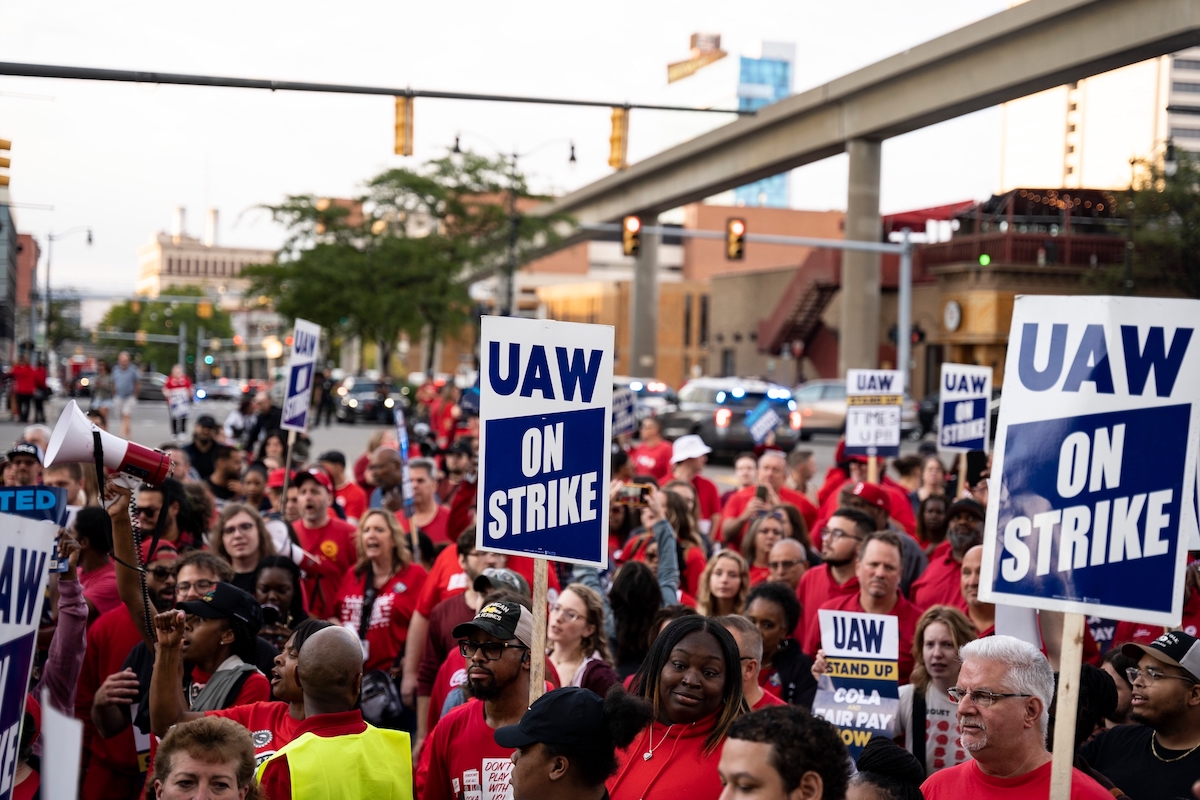

The recent automotive strike laid bare a striking inefficiency in business: an outdated approach to compensation that allocates resources in a manner almost completely unrelated to the actual value created by jobs. Automotive company shareholders should ask themselves whether letting a strike occur was the best way to establish how much workers should get paid. Instead of basing wages on what can be extracted through negotiation, doesn’t it make more sense to base compensation on how much value a job function creates in terms of impact on sales, profits, enhanced stakeholder experiences, loyalty, or other key sources of value? In no other part of business do organizations routinely allocate resources without any serious analysis of the potential return in the short- or longer term.

Do Most Organizations Really Know Where the Most Value Is Created?

There are multiple reasons why most organizations continue to use outmoded methods for determining how much to pay people in various job functions that will only get worse as labor action heats up. A primary reason is the perceived inability to measure the value creation of employees or even the return on investment of training, communications, incentives, or other investments in people. In effect, even though payroll and other expenses often account for one-half of organizational expenses, they are mostly treated as sunk costs—expenses built into operating costs because most executives mistakenly believe they cannot be measured in terms of value creation. This helps explain the striking statistic from Gallup that employee disengagement costs organizations $8.8 trillion per year—companies simply build this into their bottom lines, just as automotive manufacturers did with poor quality until the Japanese forced the US to up its quality game starting in the 1980s.

Another reason for the failure to study the source of value creation in organizations is the uncomfortable truth that the current approach to pay is remarkably beneficial to senior management with little to show for their continued inflated pay when compared to shareholder returns. According to the Economic Policy Institute, CEO compensation has grown 28.1% faster than the stock market from 1978 to 2022 and has far eclipsed the 15.3% growth in the typical worker’s annual compensation during that period. All evidence suggests, according to this report, that the rise in CEO pay is not based on any increased productivity but rather on their ability to “extract” additional pay.

The imbalance between executive and worker pay was brought to light during the pandemic. Organizations discovered that almost all their tangible assets, those accounting for an average of about 20% of a company’s balance sheet, suddenly had almost no value when employees were unable to work or customers unable to buy. The impact was so great that at one point it appeared possible that businesses would value their so-called “essential workers” and do more to improve their conditions. Instead, we are entering a period of unprecedented labor activity obviously because workers do not believe they are getting their fair share of resources or respect. Rather than viewing those essential workers as an asset to be nurtured, many businesses are going back to the traditional sunk-cost approach that bases pay on cost to replace rather than on the potential for value creation. This despite the evidence from Gallup that organizations are burying a high level of employee disengagement into their bottom lines.

Understanding Where Value Gets Created

The new world of human capital management and analytics provides a better basis for organizations to make strategic compensation decisions based not on market rates for replacing people but on the value created by different functions. In the case of positions such as sales, investment management, professions with billable hours, or other jobs which have a clear basis for measuring value creation, these principles can often be applied both to individuals and to an entire department to ensure that the money being invested in people offers a reasonable return.

So how does one go about evaluating the value created by different functions within an organization to better determine where to invest resources and how. The effort provides a useful framework for making compensation decisions that are typically better for organizations than provided by the ones negotiated at the bargaining table. It is not complicated.

- The process begins by clearly establishing an organization’s purpose, goals, and objectives, including both financial and other metrics related to its mission and values.

- Next, create a chart of the organization’s primary stakeholders, including customers, key categories of employees, supply chain and distribution partners, etc. or, if a not-for-profit, donors or volunteers, etc.

- Create a scale of one to 10 for how much each category contributes to the purpose, goals, and objectives of the organization and to gauge their impact on other stakeholders. In other words, how much would an increase or decrease in an investment in one stakeholder group versus another affect the achievement of the organization’s purpose, goals, and objectives, or the experiences of other stakeholders, in the short-, mid-, and long-term.

- The results are an approximate pie-chart showing value creation and impact by stakeholder group over time.

On the other hand, what could a strategic investment in fostering greater employee engagement, skills development, etc. have on sales, internal and external customer service, innovation, talent retention, referrals, quality management, safety, production efficiency, etc.? How would the return of that investment compare with adding more resources to the C-suite? In other words, how much more value could be created by investing in the workforce in terms of achieving the organization’s purpose, goals, and objectives versus investing more in C-suite executives or other investments in other stakeholders or projects?

Targeting Investments Toward the Greatest Sources of Value Creation

Considering that investments should be made in the stakeholders who can have the greatest impact on the purpose, goals, and objectives of the organization over time, many organizations may find through this examination that they are investing unnecessarily in functions that cannot significantly impact value creation, that is: the customers and distribution partners who consume the products and services; the employees who conceive of, develop, sell, produce, and support the product or services, and then to a lesser extent the employees or other stakeholders who support them. This doesn’t mean that companies should cut the pay of people in specific departments after conducting this analysis; however, it might mean they will rethink how much they should invest in those functions versus others over the longer term or whether they can place some people in jobs that will result in greater value creation.

Until organizations find a better means of identifying the true sources of value creation, they will continue to make decisions that lead to costly labor actions whose waste simply gets baked into the bottom line, as the automakers will do this year because the results of the strikes provided no great benefit to shareholders.

ESM Is Published by The EEA: Your Source for Effective Stakeholder Management, Engagement, and Reporting

Through education, media, business development, advisory services, and outreach, the Enterprise Engagement Alliance supports professionals, educators, organizations, asset managers, investors, and engagement solution providers seeking a competitive advantage by profiting from a strategic and systematic approach to stakeholder engagement across the enterprise. Click here for details on all EEA and ESM media services.

1. Professional Education on Stakeholder Management and Total Rewards

- Become part of the EEA as an individual, corporation, or solution provider to gain access to valuable learning, thought leadership, and marketing resources to master stakeholder management and reporting.

- The only education and certification program focusing on Stakeholder Engagement and Human Capital metrics and reporting, featuring nine members-only training videos that provide preparation for certification in Enterprise Engagement.

- EEA books: Paid EEA participants receive Enterprise Engagement for CEOs: The Little Blue Book for People-Centric Capitalists, a quick implementation guide for CEOs; Enterprise Engagement: The Roadmap 5th Edition implementation guide; a comprehensive textbook for practitioners, academics, and students, plus four books on theory and implementation from leaders in Stakeholder Management, Finance, Human Capital Management, and Culture.

2. Media

- ESM at EnterpriseEngagement.org, EEXAdvisors.com marketplace, ESM e–newsletters, and library.

- RRN at RewardsRecognitionNetwork.com; BrandMediaCoalition.com marketplace, RRN e-newsletters, and library.

- EEA YouTube Channel with over three dozen how-to and insight videos and growing with nearly 100 expert guests.

3. Fully Integrated Business Development for Engagement and Total Rewards

Strategic Business Development for Stakeholder Management and Total Rewards solution providers, including Integrated blog, social media, and e-newsletter campaigns managed by content marketing experts.

4. Advisory Services for Organizations

Stakeholder Management Business Plans; Human Capital Management, Metrics, and Corporate Sustainability Reporting for organizations, including ISO human capital certifications, and services for solution providers.

5. Outreach in the US and Around the World on Stakeholder Management and Total Rewards

The EEA promotes a strategic approach to people management and total rewards through its e-newsletters, web sites, and social media reaching 20,000 professionals a month and through other activities, such as:

- Association of National Advertisers Brand Engagement 360 Knowledge Center to educate brands and agencies.