Europe’s Big Opportunity: Turning Stakeholder Respect into Global Leadership

By Bruce Bolger

Europe Has What the World Wants

What’s Lacking? An Unfinished Economic Union

Put the Focus on Value Creation Instead of Only Disclosure

Click here to subscribe to the ESM weekly e-newsletter.

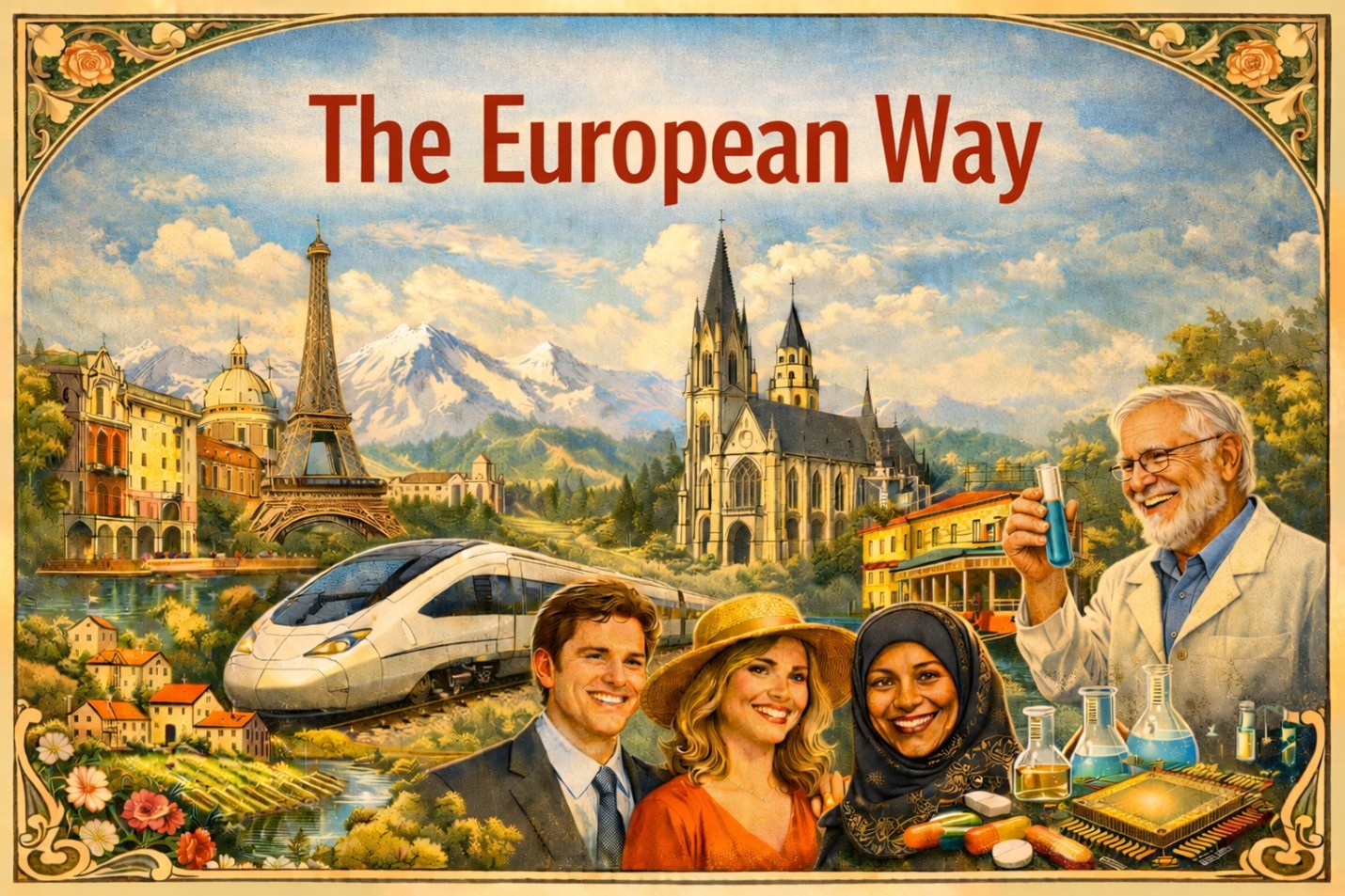

Europe’s commitment to stakeholders is not a philosophical preference or a regulatory accident. It is its brand — and a major source of its global economic

value. European companies are more widely trusted because they are designed to serve not only shareholders, but employees, customers, communities, and the environment. That trust signals quality, safety, durability, and long-term value. In global markets, “European” still functions as a premium label.

value. European companies are more widely trusted because they are designed to serve not only shareholders, but employees, customers, communities, and the environment. That trust signals quality, safety, durability, and long-term value. In global markets, “European” still functions as a premium label.What Europe has overlooked is not values, but scale—the same ease with which US companies can raise capital, minimize personal risks, and work across state borders. Europe does not have to become shareholders first to lead the world in modern capitalism, but it needs to make it easier for entrepreneurs to risk capital, reputations and time to monetize the European brand.

Europe Has What the World Wants

Europe already offers what many markets increasingly lack: institutional trust, scientific rigor, regulatory predictability, and respect for people. The question is whether it can convert those strengths into sustained global economic leadership. This is not theoretical. Europe has already produced some of the world’s most successful examples of stakeholder capitalism.

Holland-based ASML is the clearest case. Built on long-term public–private collaboration, deep investment in people and research, environmental responsibility, and decades-long supply-chain partnerships, ASML operates with stakeholder capitalism as its core operating system. The result has been extraordinary shareholder value alongside unmatched strategic importance in its domination of the market for the world's most sophisticated chip manufacturing machines.

Europe’s pharmaceutical and life-sciences leaders offer similar proof. Companies such as Novo Nordisk, Roche, Sanofi, AstraZeneca, and Bayer compete globally by pairing breakthrough science with long-term investment in talent, patient outcomes, and public trust. Their success reflects a model in which human value and scientific integrity are not opposed to profitability, but essential to it.

The pattern extends well beyond pharma and semiconductors. SAP has scaled enterprise software globally while prioritizing workforce development and long-term customer relationships. Siemens combines industrial innovation with deep commitments to employees and the energy transition. LVMH demonstrates that heritage, craftsmanship, and people-centered value creation can dominate global luxury markets. IKEA has turned affordability, sustainability, and human-centered design into a worldwide business model. Vestas shows that renewable-energy leadership can be both industrially competitive and socially aligned.

These companies do not succeed despite Europe’s stakeholder model. They succeed because of it. Yet Europe has failed to monetize this advantage at scale. Stakeholder capitalism has largely been expressed through reporting, disclosure, and regulation rather than through entrepreneurial enablement. Europe has become excellent at defining what responsible companies should look like, but less effective at creating the conditions that allow such companies to be funded, scaled, and globalized from within Europe as occurs in the US.

Transparency matters. But transparency alone does not create category-defining firms.

What’s Lacking? An Unfinished Economic Union

To compete globally, Europe must pair its values with US-style scale mechanics — without importing US-style short-termism.

That requires a deliberate shift in policy. The European Union should treat entrepreneurship and scale as strategic priorities, on a par with climate, defense, and industrial policy. Because the current approach remains highly fragmented, the EU should establish a dedicated body focused on entrepreneurship, capital, and scale, with a mandate to convert Europe’s strengths into globally competitive companies.

Europe does not have to adopt shareholder primacy to address the fundamental reasons entrepreneurs and investors seek out investment in the US, given that the EU population of about 450 million is far larger than that of the US and its GDP only nominally lower. When measured in terms of living conditions—infrastructure, sustainability, vacation time, benefits, health care, work-life balance, etc., Europe has a much higher gross happiness product.

Several steps are essential for Europe to turn its respect for stakeholders and the environment into a competitive advantage, and current US policies have given it an extra reason to do so. If there is anything to learn from the US leadership as an incubator, Europe must complete a true capital markets union, enabling pension funds and insurers to invest more actively in venture and growth equity, and reducing friction for cross-border fundraising and listings.

Put the Focus on Enablement Instead of Only Disclosure

To profit from the power of its brand, Europe must address its most acute issues, the regulatory burdens and costs associated with almost any startup depending on the country, financing gaps for supporting early and later-stage companies, particularly in sustainability, healthcare, deep tech, industrial innovation and consumer products and services embodying the European quality of life and design many Americans respect. Ideally, regulation should be simplified through a single EU-wide scale-up framework that replaces fragmented national paperwork and other regulatory regimes and accelerates time to market in strategic sectors.

Europe should also reward long-term risk-taking by strengthening incentives for patient capital, employee ownership, and founder equity retention, while reducing the cost of failure and enabling faster restarts. And it should respond to current geopolitical shifts by making itself the most attractive destination for global entrepreneurial talent — fast-tracking visas for founders, engineers, and scientists and offering a clear, predictable pathway to building and scaling companies across the continent.

None of these initiatives should require new taxes, always a sore point, nor subsidies for international firms. Europe has a quality of life that is the envy of the world.

Moments of economic realignment rarely announce themselves. They appear as policy shifts elsewhere — and as opportunities for those prepared to act.

Europe already commands trust. It already produces global champions. Despite its own challenges with immigration, integration, affordability, and labor issues in France and other countries, it already understands how to value stakeholders and communities. What it lacks is not vision, but systematic support for entrepreneurial scale.

Stakeholder capitalism is Europe’s differentiator. ASML and Europe’s pharmaceutical, industrial, and consumer leaders prove that it works. The task now is to ensure these successes are not exceptional, but repeatable.

This is Europe’s moment to stop measuring its strengths — and start scaling them.

Enterprise Engagement Alliance Services

Celebrating our 17th year, the Enterprise Engagement Alliance helps organizations enhance performance through:

Celebrating our 17th year, the Enterprise Engagement Alliance helps organizations enhance performance through:1. Information and marketing opportunities on stakeholder management and total rewards:

- ESM Weekly on stakeholder management since 2009. Click here to subscribe; click here for media kit.

- RRN Weekly on total rewards since 1996. Click here to subscribe; click here for media kit.

- EEA YouTube channel on enterprise engagement, human capital, and total rewards since 2020

Management Academy to enhance future equity value for your organization.

Management Academy to enhance future equity value for your organization.3. Books on implementation: Enterprise Engagement for CEOs and Enterprise Engagement: The Roadmap.

4. Advisory services and research: Strategic guidance, learning and certification on stakeholder management, measurement, metrics, and corporate sustainability reporting.

5. Permission-based targeted business development to identify and build relationships with the people most likely to buy.

Contact: Bruce Bolger at TheICEE.org; 914-591-7600, ext. 230.