Another Major Study Finds Happier Employees Drive Higher Profits, Stronger Company Value, and Better Stock Performance

What Makes This Research Unique

Key Findings

Why This Matters for Business Leaders

The empirical data from highly respected academic institutions is piling up. Organizations with highly engaged, recognized, appreciated, and happy

employees do better on the stock market.

employees do better on the stock market.Using crowdsourced data from over a million employee experiences on Indeed, the authors claim their research is the most comprehensive investigation to date on how happiness at work influences company success.

A new working paper—Workplace Wellbeing and Firm Performance” (Oxford Wellbeing Research Centre, Working Paper 2304)—concludes that companies where employees report being happier, more purposeful, more satisfied, and less stressed perform significantly better on virtually every financial measure studied.

Led by researchers Clement Bellet, Assistant Professor, Erasmus University; Jan-Emmanuel De Neve, Professor of Economics and George Ward, Junior Research Fellow, at Oxford University, the study finds that workplace wellbeing is linked to higher profitability, greater firm value, and stronger stock market returns, even after accounting for industry, company size, and other key variables. For businesses navigating a rapidly changing labor market, the implication is clear: wellbeing isn’t a perk—it’s a strategic asset.

Using a different methodology, the researchers reach similar conclusions to that of the Human Capital Factor, an index developed by Irrational Capital that has also found a direct link to cultures in which employees feel recognized and appreciated to future equity value creation. See ESM: The Holy Grail of Investing and Human Resources: New Solution Connects Human Capital to Return on Equity.

What Makes This Research Unique?

While many earlier studies have speculated about the link between happy workers and business success, most relied on small samples or indirect proxies

for culture, such as “Best Places to Work” lists or generalized ratings on sites like Glassdoor. This authors believe this study stands apart for its scale, precision, and real-time measurement:

for culture, such as “Best Places to Work” lists or generalized ratings on sites like Glassdoor. This authors believe this study stands apart for its scale, precision, and real-time measurement:1. Massive, never-before-used dataset

- Draws on 1 million+ employee wellbeing surveys from Indeed, one of the world’s largest jobs platforms.

- Covers 1,782 publicly traded US companies across sectors.

- Includes responses only from current employees, increasing accuracy.

- “I am happy at work most of the time.”

- “My work has a clear sense of purpose.”

- “I am completely satisfied with my job.”

- “I feel stressed at work most of the time.” (reverse-scored)

affect (happiness/stress), evaluation (satisfaction), and purpose (meaning).

3. Strong matches to real financial outcomes. The researchers matched wellbeing data to high-quality company performance metrics including:

- Return on Assets (ROA) – a profitability measure

- Tobin’s Q – capturing firm value and expected growth

- Gross profits

- Stock performance (via a simulated investment portfolio)

Key Findings

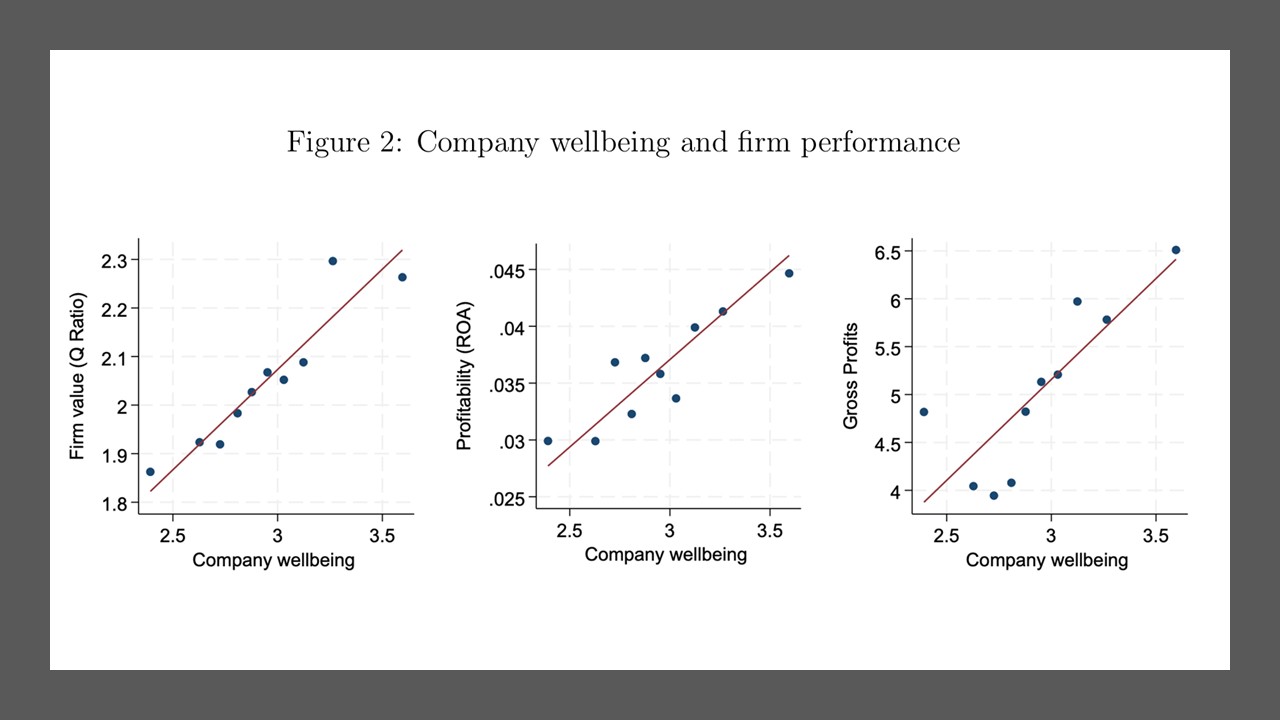

1. Happier employees are linked to higher profits. A one-point increase (on the 1–5 scale) in average employee happiness corresponded with:

- 1–1.2 percentage-point increases in ROA

- $1.3–$2.3 billion higher annual profits (depending on the model)

2. Happier employees corresponds with stronger company value. Companies with the happiest employees posted significantly higher Tobin’s Q scores—meaning markets expect better future performance and growth.

3. Workplace wellbeing predicts future success, not just present-day performance. Wellbeing levels measured before the COVID-19 pandemic predicted better financial performance in 2020, 2021, 2022, and 2023. This is key, the authors feel: employee wellbeing is not just correlated with performance—it's a forward-looking indicator.

4. The alpha potential: high-wellbeing companies outperform the stock market. In a simulated portfolio using the Top 100 wellbeing companies each year:

- Average annual returns were 14.8%, compared to 13% for the S&P 500.

- $1,000 invested in high-wellbeing firms in 2021 grew to $1,533, beating the S&P 500, Nasdaq Composite, and Russell 3000.

5. The effect holds across multiple wellbeing dimensions. Happiness, purpose, and job satisfaction all predict stronger financial performance.

Stress shows weaker relationships—likely because some stressors are harmful, while others (like challenge stress) can sometimes motivate performance—but the general pattern is clear: positive wellbeing matters most.

Why This Matters for Business Leaders

1. The “people-performance loop” is real and scalable. The analysis, supported by decades of micro-level evidence, shows that employee wellbeing boosts performance through:

- Increased productivity

- Better teamwork and customer service

- Higher creativity

- Improved physical and mental health

- Easier recruitment

- Stronger retention

2. Wellbeing isn’t a “nice-to-have”—it’s a competitive advantage. Eight-seven percent of executives say wellbeing would boost competitiveness, but only a third make it a strategic priority. This research shows that underinvesting in wellbeing leaves financial value on the table.

3. Investors should pay attention. Because markets underreact to wellbeing information, high-wellbeing companies may represent an overlooked opportunity for alpha.